A Beginner’s Guide to Online Banking

By Braden Smith | July 25th, 2018 | Banking

This post may contain sponsored links, view the affiliate policy.

Ever since online banking was introduced in 1981, it has allowed banking customers to access their accounts, make transfers, and perform simple to complex banking tasks from anywhere in the world. Be it on the subway making a transfer to auntie suzzi, or at the Starbucks checking your account balance before you buy a vente iced caramel macchiato with extra shots, online banking is simply convenient. With real time updates, fraud alerts, notifications, encryption, and a whole lot more of those bells and whistles, online banking was designed for the consumer, you.

What is online banking?

A Quick History: Originated in the early days of personal computing, online banking was developed in the early 1981 by four major banks in New York City, Chase Bank and Citibank included. Not gaining much popularity until mid to late 1990s and early 2000s, a boom of consumers began surfing the internet and using computers on a daily basis, allowing the banks to become profitable online and offer a wide variety of different services through their websites. Years following, millions of people began to bank online, as new and improved websites are developed, modern security is implemented, and mobile applications are born.

Online Banking Services: Simply open accounts, check balances, pay bills, transfer funds, deposit checks, view transaction history, and having a piece of mind are all functions of banking online. Some banks will offer around the clock customer support to answer all of your questions and take care of your banking needs which provides plenty of value to the banking experience.

Pros of online banking:

- Accessibility – Perform banking tasks from any smartphone or computer, as long as there is internet connectivity and a web browser.

- Efficiency – Check account balances or make transfers in seconds, without needing to walk into a physical branch, saving time.

- Cost – Banks don’t charge to use their online banking platforms to check account balances, view financial history, or contact support.

- Security – Online banking platforms provide a high level of encryption and fraud detection to fend against unauthorized access and fraudulent charges. Deposits are also insured for at least $250,000 if the firm is registered with the FDIC or NCUA.

Cons of online banking:

- Human Interaction – All customer support is done through a technical support phone number, live chat, ticketing system, or e-mail. There is little to no human interaction when it comes to solving technical issues.

- Internet Access – Online banking requires a stable connection to the internet via Wi-Fi, cellular data, or Ethernet connection. Some people don’t have access to the internet and would not benefit from banking online.

- Hackers – While even encryption and security play a big part in keeping accounts safe, it’s still up to the consumer to keep an up-to-date anti-virus protection on their device to ensure no malicious programs attempt to steal financial information when logging into the online banking platform. No bank can control what programs or apps run on the consumer’s machines. We highly suggest Malwarebytes anti-virus, which supports Windows, Mac, iOS, and Android.

How do I use online banking?

Online banking is very easy to use once you’ve become familiar with the online platform be in the form of a website or mobile application. There are multiple steps that you will go through in order to get started with banking online. Simply follow along or use this guide to understand how the process typically works with an online solution to banking. As a reference for this guide, we will be using Bank of America. This online banking guide will feature some of the most popular pages and functionalities that banks and credit unions will offer.

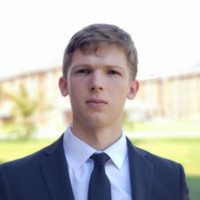

1. First of all, you will need to acquire an account with the financial institution. Here we will fill out all of the pertinent information such as Name, address, social security number, and contact information. Sometimes you can also enroll in online banking right on the same application. If there is no option, you will need to see step 2.

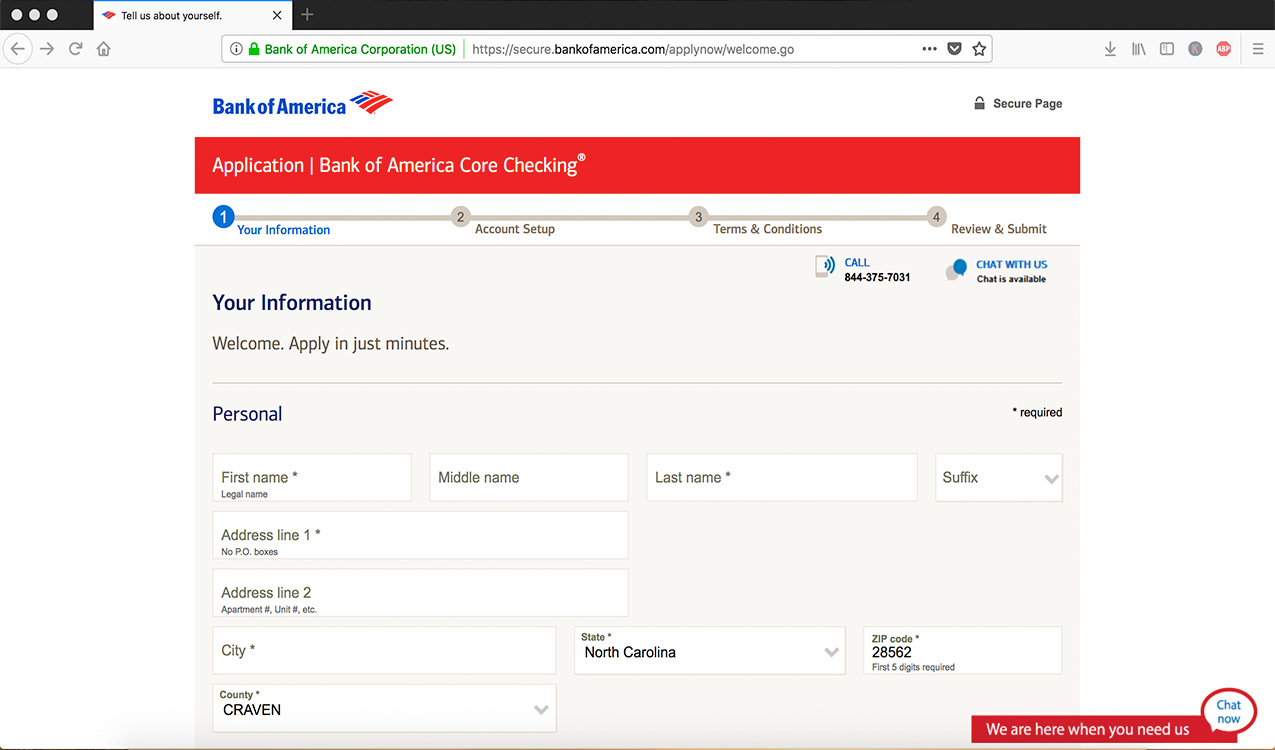

2. Once you have a checking or savings account with the bank, you can then enroll in their online banking platform. On this screen, we will fill out all the necessary information needed to allow the bank to properly enroll us in the online platform. Submit the application and check your email or wait for a response from the bank that lets you know if your application has been accepted or not.

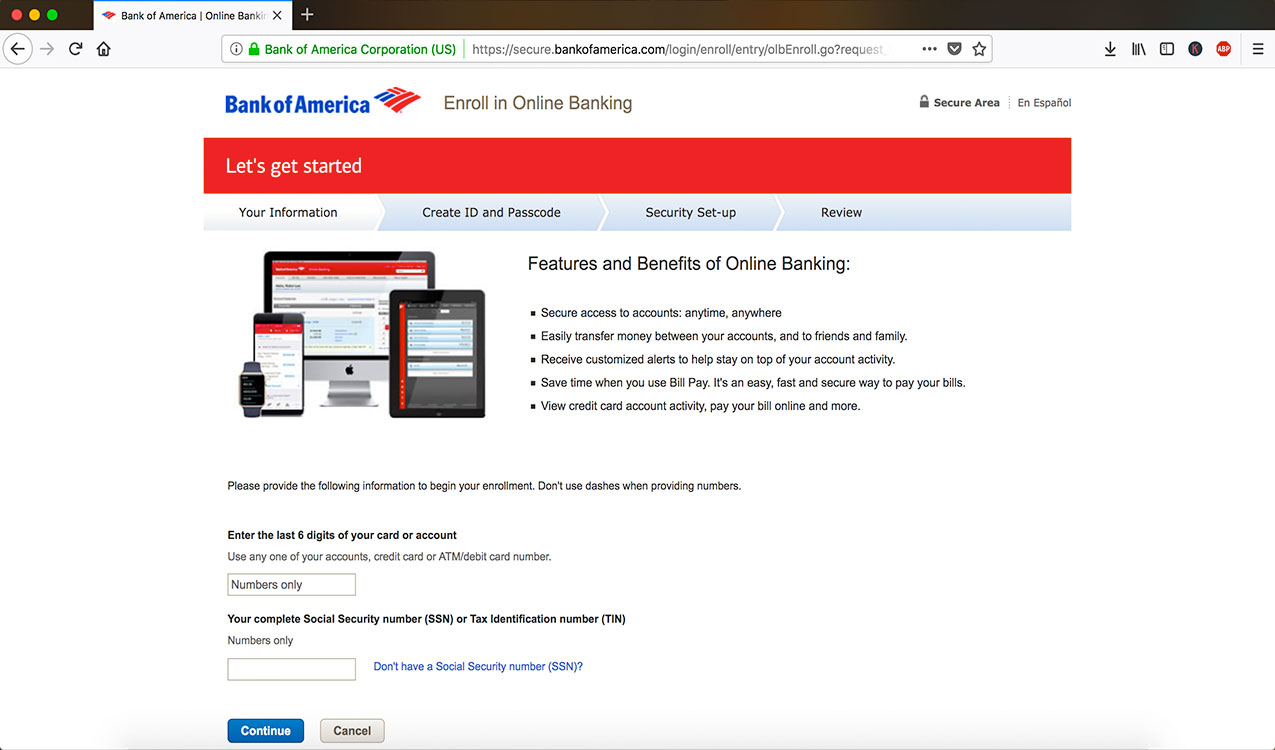

3. Now that you have an account to access the online platform, we can explore the different features of online banking. On the main account screen, we can see our checking and savings accounts, along with their balances and different features that we can choose from. We can also receive money from someone by giving them our account number and routing number that is located on this screen.

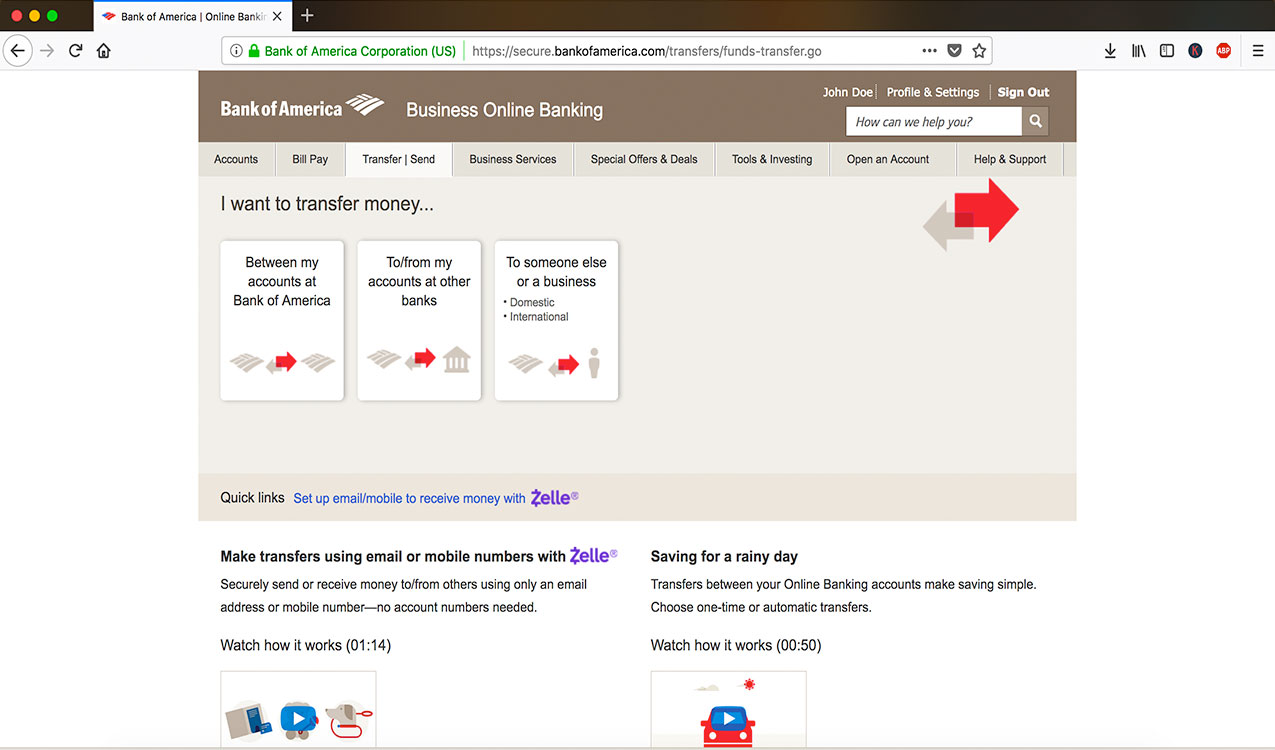

4. On the transfer funds page, we can send money via wire transfer or send money to another bank account located in the United States. Beware of the different fees associated with each bank. You can find a comprehensive list here on each bank. International Wire Transfers are the cheapest when you use a service like Transferwise.

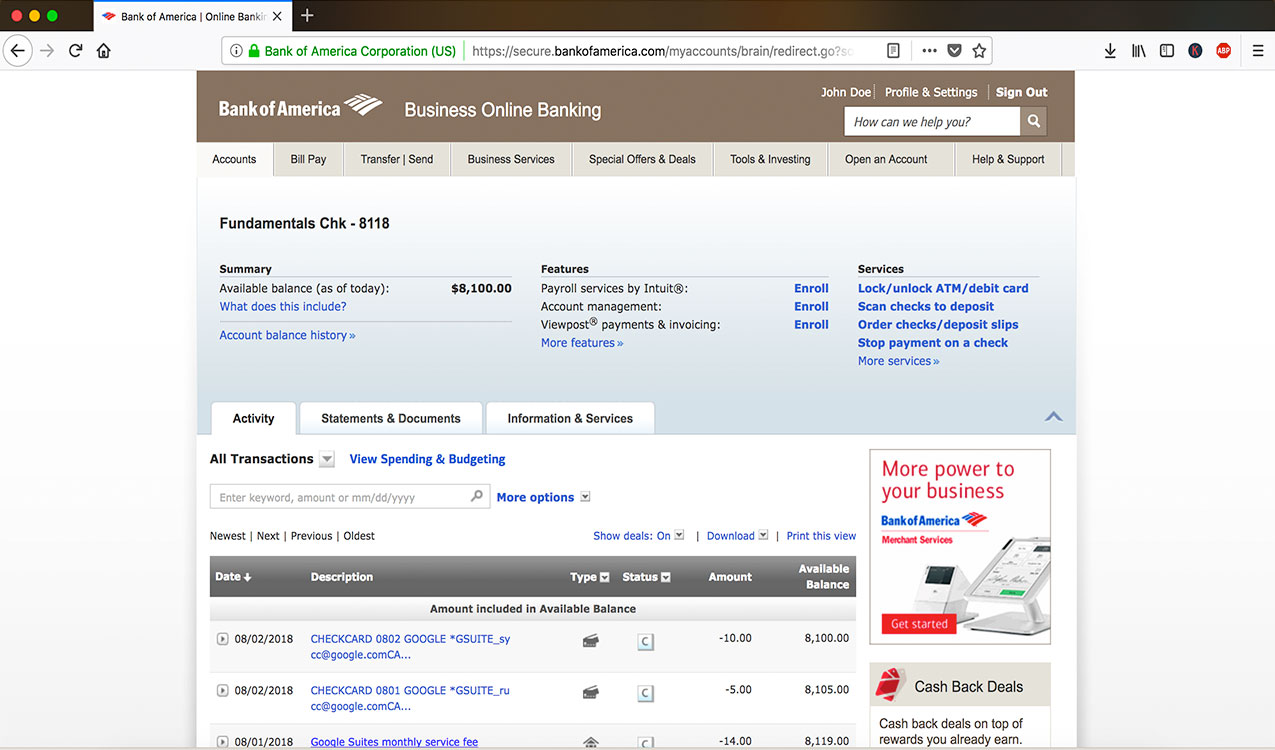

5. This is the statements page, displaying previous expenditures, deposits, transfers, and loan payments. We can look all the way back when our account was first opened and determine how our money was spend and how much we received. Custom statements can be generated with a click of a button.

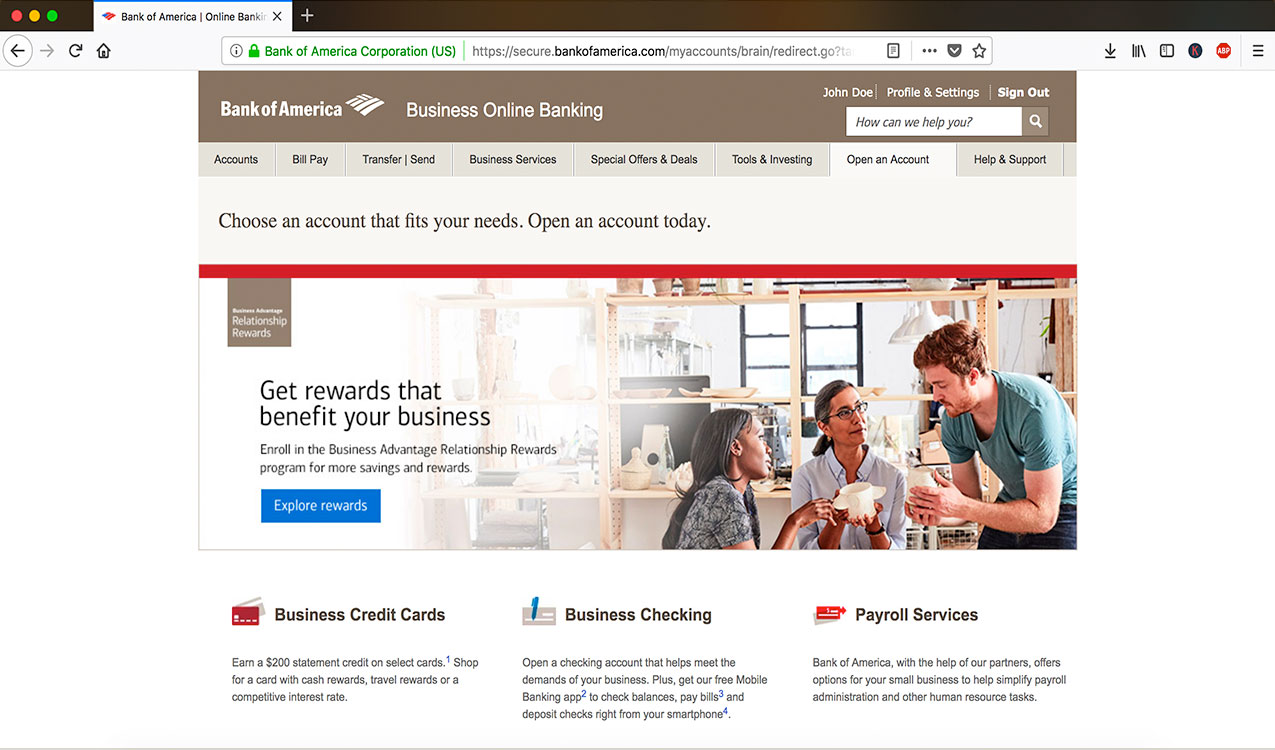

6. Some banks may let you open new accounts right within the online banking platform. Here is a page that displays all the possible accounts we could start using, providing a list of the uses, fees, terms, and other factors associated with the account.

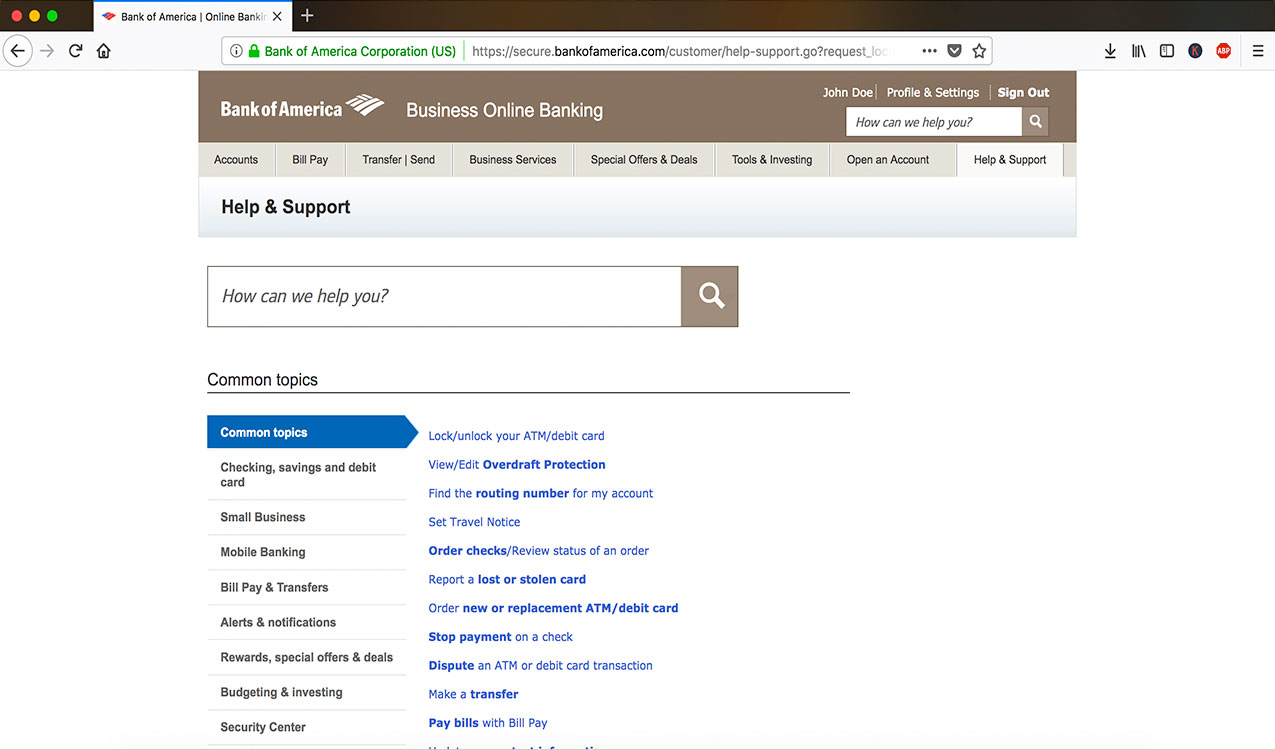

7. Here is the support page, in which we can find useful contact information for the bank, and get help when we need it. Many banks will offer a main support line, and some even offer a live chat or callback service.

1. First of all, you will need to acquire an account with the financial institution. Here we will fill out all of the pertinent information such as Name, address, social security number, and contact information. Sometimes you can also enroll in online banking right on the same application. If there is no option, you will need to see step 2.

2. Once you have a checking or savings account with the bank, you can then enroll in their online banking platform. On this screen, we will fill out all the necessary information needed to allow the bank to properly enroll us in the online platform. Submit the application and check your email or wait for a response from the bank that lets you know if your application has been accepted or not.

3. Now that you have an account to access the online platform, we can explore the different features of online banking. On the main account screen, we can see our checking and savings accounts, along with their balances and different features that we can choose from. We can also receive money from someone by giving them our account number and routing number that is located on this screen.

4. On the transfer funds page, we can send money via wire transfer or send money to another bank account located in the United States. Beware of the different fees associated with each bank. You can find a comprehensive list here on each bank.

5. This is the statements page, displaying previous expenditures, deposits, transfers, and loan payments. We can look all the way back when our account was first opened and determine how our money was spend and how much we received. Custom statements can be generated with a click of a button.

6. Some banks may let you open new accounts right within the online banking platform. Here is a page that displays all the possible accounts we could start using, providing a list of the uses, fees, terms, and other factors associated with the account.

7. Here is the support page, in which we can find useful contact information for the bank, and get help when we need it. Many banks will offer a main support line, and some even offer a live chat or callback service.

As you can see, there are many useful functions that online banking offers at the convenience of typing in the website and logging in. Banks offer web solutions for both consumers and businesses alike, and cater to millions of individuals a year through its online platform. Many people don’t even go into the physical branches anymore and heavily rely on the banking website and mobile application to get the job done.

Is online banking safe?

Your money is insured: A majority of banks are insured by the Federal Depository Insurance Corporation (FDIC) and will protect against unauthorized spending, transfers, and fraudulent activity. Likewise, the National Credit Union Administration (NCUA) insures deposits on credit unions .The FDIC and NCUA insure each depositor at least $250,000 as long as the institution is a member firm. Most banks and credit unions will have the respective regulatory logo in the footer of their website. You can also check here to see if your institution is insured by the FDIC or NCUA.

Today’s sophisticated encryption: Financial institutions are required by law to provide a safe and secure environment for consumers to participate in online banking. In the past, encryption was not very strong and allowed for intruders to crack into online sessions to steal banking information. Today however, banks employ top of the line 256-bit encryption that ensures all online sessions are secure. When doing online banking, it is best to check for Hypertext Transfer Protocol Secure (https) in the URL of the browser. This is an indicator of a secure session, in which information is securely going between you and the bank.

What are the risks associated with online banking?

You may receive an email asking you to confirm your banking information or a delightful email boasting about the promotional offers you could receive if you just send them your password. These are examples of phishing attempts and should not be taken lightly. E-mails may come from a similar email address to your bank and could even have your name on it. There also may be a link in the email to a familiar banking website, but don’t click it because it’s to a phishing website that looks exactly like your bank’s. Once you enter your financial information into the website, your account is now compromised.

Receiving a phone call from your friend, family, or bank asking for your account number is an example of social engineering. Con-artists will pose as a familiar face and give you a story about how your account is compromised or how you may owe the bank money. There are many different scenarios where social engineering can happen.

When perusing the web, you may stumble upon a website that informs you to download a file or enable adobe flash, but if you aren’t familiar with the website or have never heard of it before, it’s best to avoid it. If you enable adobe flash or download a file and open it, you could potentially put your entire network at risk of being hacked. Hackers will develop malicious programs to steal information from your machine over long periods of time. Some viruses can even stay dormant for years, waiting until you browse a certain website.

How to I keep my financial information safe?

Whenever you get a new computer, it’s best to have a top of the line Anti-Virus protection to mitigate any type of viruses or suspicious programs running on your computer or smartphone. Many anti-virus suites will immediately detect threats in real-time and help ensure your online activity is safe from hackers. We recommend Malwarebytes virus protection as the #1 recommended anti-virus suite for Windows, Mac, iOS, and Android. An anti-virus protection is a key staple of staying secure online, and will always be the best protection against unwanted threats.

Don’t open suspicious emails from friends, family, coworkers, or businesses. Opening malicious emails could lead to viruses, blackmail, or phishing attempts. If you notice a suspicious email from someone posing as a bank, you can contact the bank’s fraud department and file a report to ensure nobody else falls victim to the attack. With an anti-virus, you can protect yourself against a computer virus in the event that you opened the email and it contained a malicious attachment.

Try to avoid public Wi-Fi for online banking and all personal related matters, but it can be difficult if you are always on the go. A virtual private network (VPN) will ensure your computer or smartphone is using an encrypted connection at whatever access point or location you choose. If you must login to online banking or email for example, a VPN is a must in a public setting. This will encrypt your connection between you and the bank, and ensure nobody is listening. We highly recommend ExpressVPN as they offer a 256-bit encryption, a wide variety of connection points to mask your location, and great customer support.

If you receive an e-mail or phone call from your bank, never give out personal identifiable information or banking credentials. If you’re unsure if it’s your bank or a scam artist on the phone, hang up and call the number listed on the bank’s website, which can be found here. Report suspicious phone numbers to the bank’s fraud department line to help other consumers combat these malicious attempts.

Consider enabling 2-factor authentication (2fa) when logging into the bank’s website or smartphone app. One factor would be your password, and a second could either be a fingerprint, pin-code, or security question. This is very important because if a hacker gets your username and password, it’s unlikely that they would have your pin number or a copy of your finger to use. If you are unsure how to setup 2fa, contact your bank or look here for simple how-to tutorials.

Change your password every few months to promote security and help rid of any potential unauthorized login attempts. When you make a new password, you will want to include symbols, numbers, and both uppercase and lowercase letters. Secure passwords should be 12 to 15 characters including uppercase and lowercase letters, numbers, and symbols. Passwords should never be repeated and should always be unique.

How do I get help?

If you suspect that you’re a victim of bank fraud, identity theft, or credit card fraud, don’t hesitate to report this incident to your financial institution’s fraud department. You should also notify the local police of the occurrence so it can be properly documented in a police report, as it could be useful to have in the dispute process. This should be done within two days of the occurrence because it will give the bank enough time to try to recover the funds and claw-back any fraudulent transfers or expenditures. Bank fraud department phone numbers can be found here or on the respective financial institution’s website.

Does my bank offer online banking?

While many large financial institutions offer online banking, some smaller institutions may not. If you’re unsure if your bank offers online banking, you can find your bank here, or search online for the website. Online banking is very common among smaller banks, even though it’s possible that they only do banking via physical locations.

Our website allows consumers and businesses to find banking information without a hassle and multiple searches through the internet. We compile contact information, websites, mobile applications, banking fees, routing numbers, and much more about each financial institution. As there are hundreds of different banks throughout the United States, we are always adding more to our online database.