Finn by Chase Bank Review

By Braden Smith | October 12th, 2018 | Banking, Checking Accounts, Savings Accounts

This post may contain sponsored links, view the affiliate policy.

Take control of your money with Finn by Chase, a mobile banking platform aimed at being the best. Enjoy ZERO monthly service fees, access to over 29,000 free ATMs, and a whole lot more.

Finn by Chase: A History and Overview

Chase Bank trademarked ‘Finn by Chase’ in early 2017, sparking interest from industry reporters. Finn by Chase was introduced to the market in October of 2017, confirming rumors of a mobile-only bank offering. Because Finn by Chase operates within an app, it’s primarily targeted towards millennials and the smartphone savvy.

Finn by Chase offers a unique approach to mobile banking, allowing users to rate purchases and save automatically. Users can download the app from the iOS app store on a mobile device. Android users will soon have access to Finn by Chase, as development plans are currently in progress.

Chase Bank’s goal of launching Finn by Chase is to offer retail banking services to everyone across America. The bank operates physical locations in only a few states, which previously limited their reach to consumers.

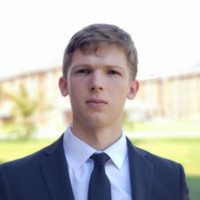

Some have criticized Chase for the app’s appearance and functionality, but those people probably never had an account. The dark grey background and colorful bubbles give off an appearance of sophistication and usability. Compared to other banking apps, the navigation and functionality is simple, but extremely powerful.

Innovative App Features

Finn by Chase offers many new and never before seen budgeting tools aimed at saving money and tracking expenses. These useful app features should be used in combination with one another.

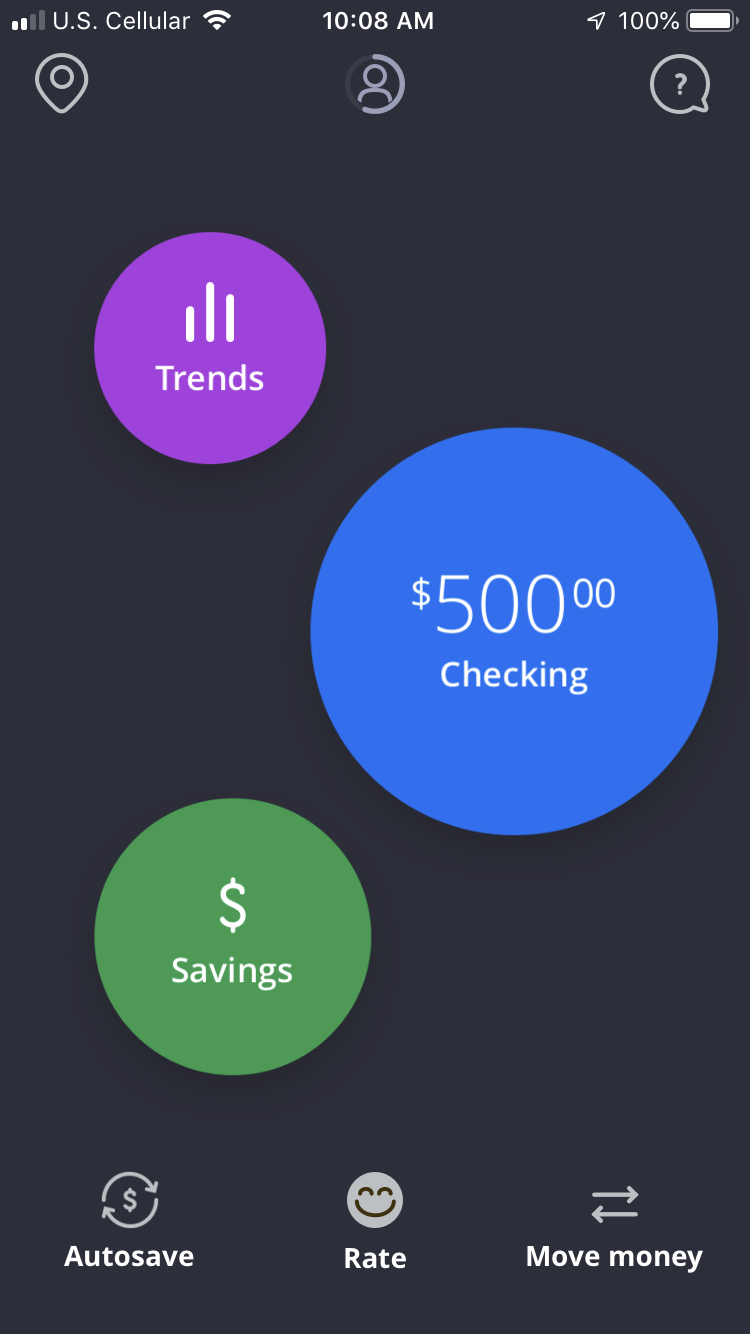

Rate Your Purchases

The realization of wants and needs is important with personal finance, and trying not to spend more than what’s made. Finn by Chase does a great job at helping consumers rate their purchases from Good to Bad, opening a new view on what money gets spent on.

Whenever you make a purchase, the app will allow you to give it a rating.

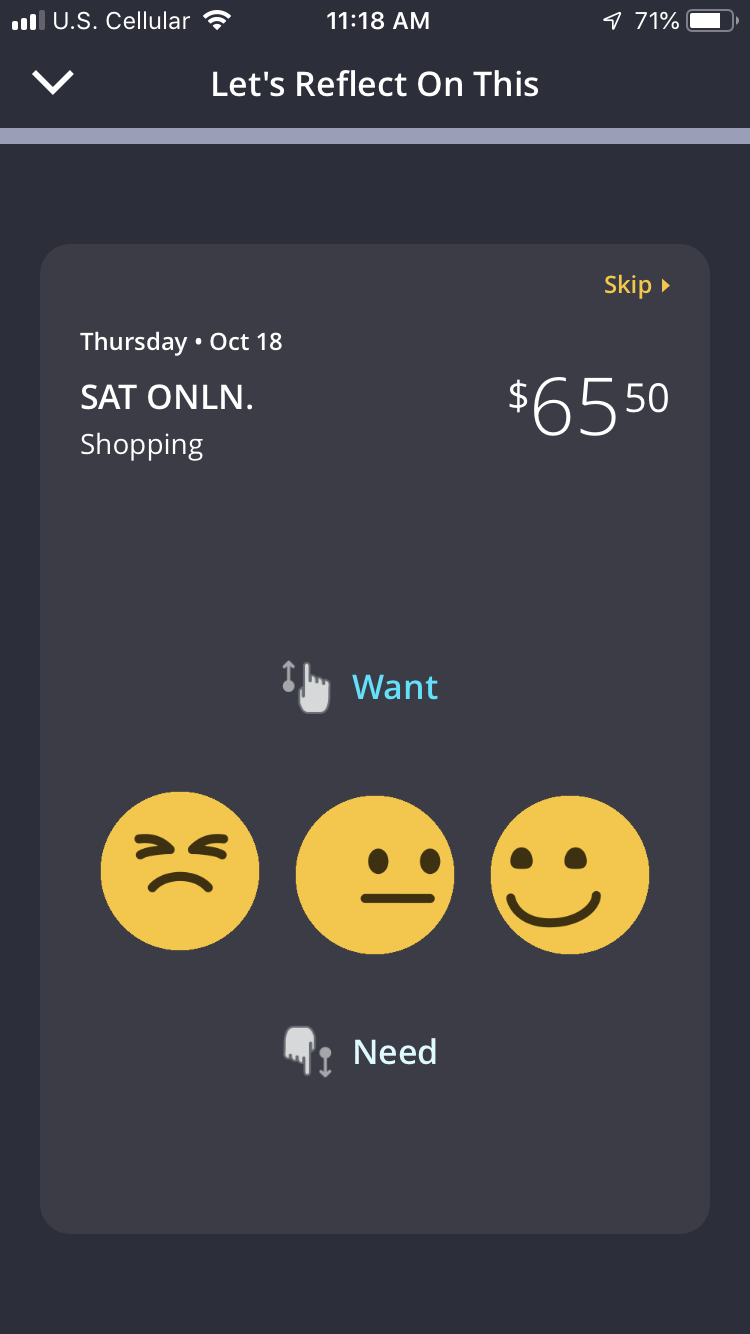

Save Automatically

Say goodbye to manually transferring money from your checking to your savings.

Autosave rules allow you to save money automatically when different instances occur within your account.

Here are the different ways in which you can save your money automatically:

When you…

- make a favorable, neutral, or compulsive purchase,

- receive a direct deposit or get paid,

- spend a certain amount of money,

- spend money at a specific location.

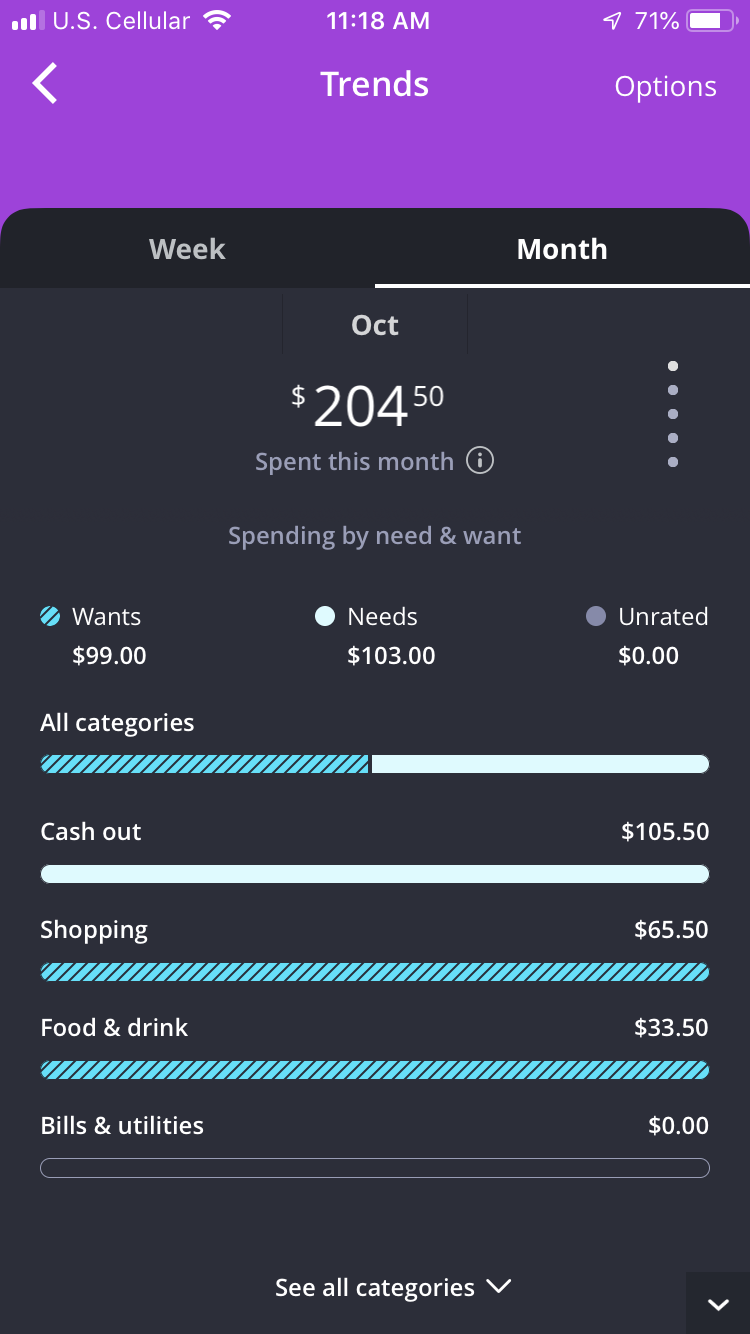

Track Your Spending

Once you’ve made a few purchases, the data is then compiled into simple charts. The simplicity of the charts can help you gain a detailed perspective on your spending habits and trends. You can see how much money you spent, and what it was spent on.

Food & Drink, Transportation, and Shopping are some of the different categories that purchases get grouped into, allowing for more transparency on where money is spent.

Get $100 when you open a new account with Finn by Chase

Simply meet these requirements within 90 days to earn a bonus:

- Be a first-time Chase checking customer

- Complete at least 10 qualifying transactions within 60 days of opening your new Finn account.

- Keep your account open for 6 months.

Easy enough, right? Check out other important details about the bonus offer.

Account Perks

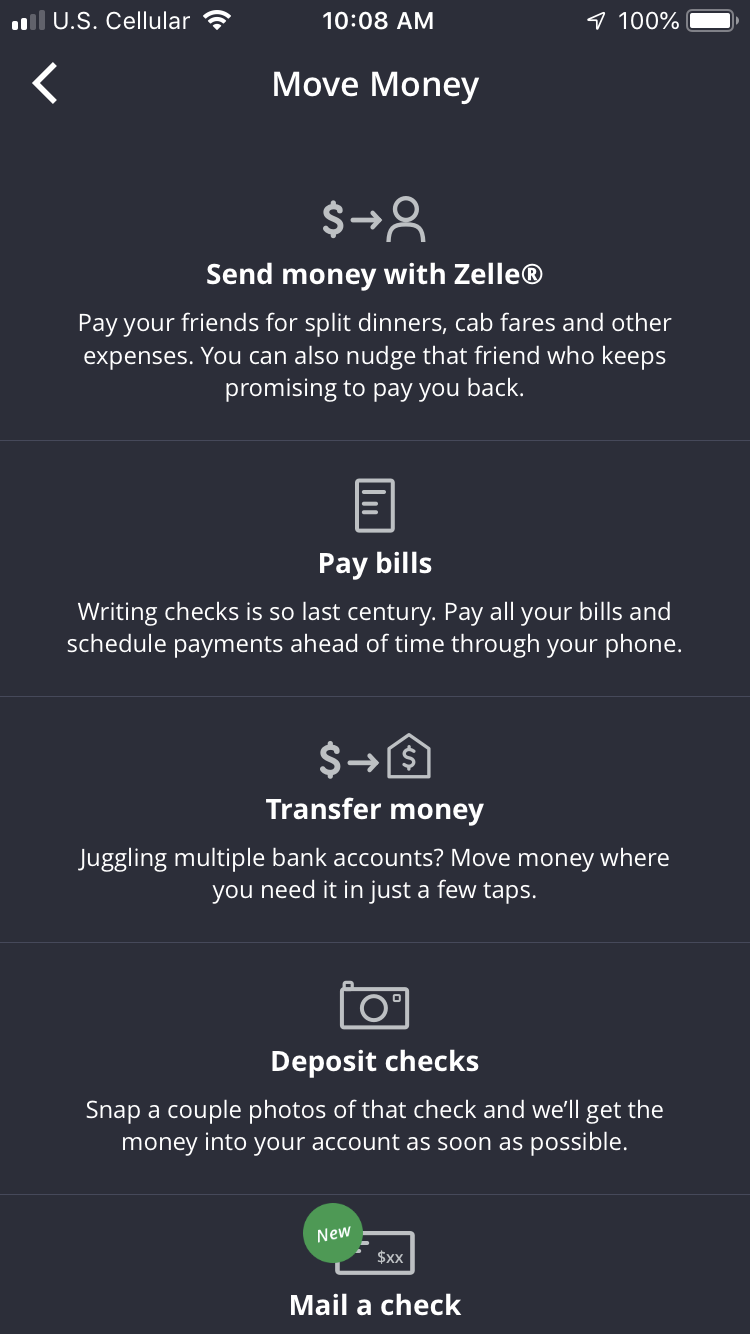

Send Money to Friends’ In-app

If you need to pay someone who also has Finn by Chase, the money will be sent almost instantly. Likewise, Zelle is also integrated into the app, letting you send money to people without Finn by Chase.

There is a daily limit of $2,000 per transaction and monthly limit of $16,000 with Zelle.

24/7 Customer Support

Something you wont find at every bank, 24/7 customer support via phone or messaging service. Finn by Chase is always ready to solve your issues, not just when it’s convenient for them.

Check out Finn by Chase’s support webpage.

Get Your Own Debit Card

Being able to spend money wherever and whenever you want is the key to a great bank. Finn by Chase has nailed down flexibility with their signature Finn card, which is black in color, and looks like something a billionaire would carry around.

Zero Banking Fees

Pay zero monthly maintenance or minimum balance fees, ever. Finn by Chase operates online and has less of an overhead than its primary banking division of Chase Bank. Fees can thought of as a waste of money, especially when you’re not a millionaire.

Direct Deposit: Take a Picture

Simply take a picture of your check and have it deposited in your account in no time. Not many banks offer this time saving feature.

Trusted By Millions

The parent company of Chase Bank has deposits of over $1.3 Trillion. Millions of people trust Chase Bank for their daily banking needs.

Security Measures

Chase Bank is registered with the Federal Deposit Insurance Corporation (FDIC). This means that deposits are insured for up to $250,000 in the case of theft or the bank’s demise.

If you lose your phone, you can login to the Chase.com website with your Finn by Chase username and password. Here, you can manage your money until you find your old phone or buy a new one.

Finn by Chase offers 128-bit Secure Socket Layer (SSL) to maximize the encryption between you and the bank. It’s like an unbreakable force-field that no hacker can penetrate.

Is this your first online banking experience? Check out Online Banking 101 – A Simple Guide For Beginners.

How Can I Apply?

Applying for Finn by Chase is pretty easy, but you must meet some criteria before you give it a go. First, if you have a Chase account, you can simply login into the Finn by Chase app to save some time. So here’s the criteria you must meet:

- At least 18 years old,

- Possess a Social Security number (and have it available),

- Live and have an address within the United States,

- Own a mobile iOS device (because Android hasn’t been released yet),

- Consent to a soft credit check (not a hard inquiry).

Finn by Chase is currently only open to United States citizens, but this could change in the future. Chase will conduct a soft credit check to ensure you’re eligible for Finn by Chase. The soft credit check is not a hard inquiry, so don’t worry about it impacting your credit score.

NOTE that Chase Bank uses ChexSystems to report and inquire about bad banking history. If you’re worried about being denied because of previous issues at other banks, don’t sweat it. Check out this compiled a list of 6 banks that don’t use ChexSystems.

Finn by Chase: Pros and Cons

Finn by Chase is a great online-only app to do banking with, but is it missing something important? That all depends on your expectations of an app created for saving money and convenience. Because there’s so many features, we’ve highlighted some of the most important advantages and little disadvantages of Finn by Chase.

Finn By Chase: Advantages

- Great tools – The many different tools within the Finn by Chase app are useful and easy to use. Be it saving money from every paycheck, to determining wants versus needs, Finn by Chase has done their research. Ingenious concepts like automatically saving money and rating purchases makes this bank standout versus competitors.

- Customer service – The 24/7 support feature was created with the customer in mind. Whenever you have a simple issue or advanced problem, the Finn by Chase support team are always on standby. Not only is there a support phone line, but there is also a messaging service built into the app for anytime customer service.

- Trusted and insured – The Chase banking network currently has over $1.3 Trillion is deposits. Not only can they be trusted to manage money, but they can be trusted to deliver quality apps like Finn by Chase. The FDIC has insured this company for $250,000 per account, meaning that all deposits are safe from the bank ceasing operations..

- Zero fees – Everyone hates paying unnecessary fees for things like account maintenance or not meeting a monthly account balance threshold. With Finn by Chase, there’s no need to worry about wasting hard earned money on fees because they understand.

Finn By Chase: Disadvantages

- Not yet on Android – Finn by Chase is currently in the process of developing an Android App to offer its services to most smartphone consumers. Unfortunately, it has been a while since there has been some information regarding this development, so we’ll chalk it up as a disadvantage. Hopefully there will be some information soon (so we can remove this).

- No retail locations – It is an online-only bank, but some people will probably have the defense that it should have a few locations. Well, I’m sure if there was something really wrong, like all your money missing, you could walk into a Chase retail location. Online-only banks operate with relatively low overheard, meaning little to no fees are charged.

Get $100 when you open a new account with Finn by Chase

Simply meet these requirements within 90 days to earn a bonus:

- Be a first-time Chase checking customer

- Complete at least 10 qualifying transactions within 60 days of opening your new Finn account.

- Keep your account open for 6 months.

Easy enough, right? Check out other important details about the bonus offer.